Hey friends! Welcome back to my Building a Home blog series where each week I am diving into a different building topic. Given that I am trying to go somewhat in order, this particular topic may not be helpful for the phase of building you are in, but I am hoping it will help nevertheless. As always, feel free to contact me with any questions you many have (contact info in blog).

Loan Process.

Today I thought I would touch briefly on different loan processes. The information will likely be different for each one of you reading this as it varies with what type of loan you are applying for, as well as your location. Because of this, I wanted to discuss what our process was like and what I wish I would have known.

If you are thinking of building a home, or in the process, you know that it is a huge financial investment. For many of us, it is the biggest financial investment you will make in your lifetime. Seeing that building a home is expensive, the loan process will be a little different than your conventional loan if you were to purchase a home already built.

Our experience

Our timeline looked something like this. We sold our house in April of 2018 and began talking with builders. We completely closed on our conventional home loan before we applied for our new construction loan. We did not want to worry about two mortgages so we sold our home and moved in with my in-laws before starting the process of our new construction loan.

our first attempt with a home lender

The bank we went with for our final new construction loan was not the first bank we originally talked with, and here is why. The first bank was the same bank my husband worked with to get financing on our condos. He had a good experience with this lender so we decided to try for our home loan. Unfortunately, the process of this bank was unlike our previous bank lenders, where they wanted all the information up front for complete pre-approval before moving forward.

Now this absolutely would not have been an issue, but the way this particular lender went about gathering the information was entirely unprofessional.

why it didn’t work out

Prior to applying for our home loan, I had been a stay at home mom after a severe bout of postpartum. I had decided to go back to work when we decided to build our home. Unfortunately, the experience I had when discussing my personal reasoning for leaving work for only 9 months was not acceptable by this bank. This lender in particular made me feel very guilty for not having any income during my time home even though I was back to work and making plenty of money to support our mortgage. What was even more frustrating was that we had a hefty down payment from the sale of our previous home and I felt like I was being judged for being home, even though it was minimal time

find a lender who supports your story

Eventually we transitioned to our hometown bank that we had taken out two previous home loans with. Our lender treated us like family immediately. She never held it against me that I stayed home for a short time to care for myself, and at the time a sick baby.

The loan process is stressful. I won’t lie to you. Lenders want to ensure you are able to support your family and your new mortgage. I think there is something to say with how you are treated. Purchasing a home or building a home is emotional stressful and your lender should be on your team to support you. For me personally, I felt really attacked with the first bank. Banks need to look into your finances very strictly. This absolutely needs to happen, but I do believe this can be done professionally and with empathy as we all have stories and situations that arise. For me, this was taking a small time off of work to care for myself and my child.

| after closing on our construction loan |

Be prepared to give details, and try and remember it’s part of the process.

If you are thinking about building a home, be okay interviewing different lenders. It is important to ensure you feel comfortable with your lender. Building a home is emotional. It’s helpful if you are prepared ahead of time for the many processes you will go through. With banks you will need to provide many income statements, pay stubs and tax forms. Basically, a reflection of your income for the past few years. This will include any side income as well as any explanation for time off of work.

putting emotion aside & trusting the process

It is a business process but it can certainly make you feel inadequate and undeserving. If you can remember going into this, that it is just part of the process it will be much easier. Though difficult and at times frustrating, this part does not last forever! To be completely transparent, I hated this part, but once we found a lender that treated us kindly things started looking up and we were able to be excited once again!

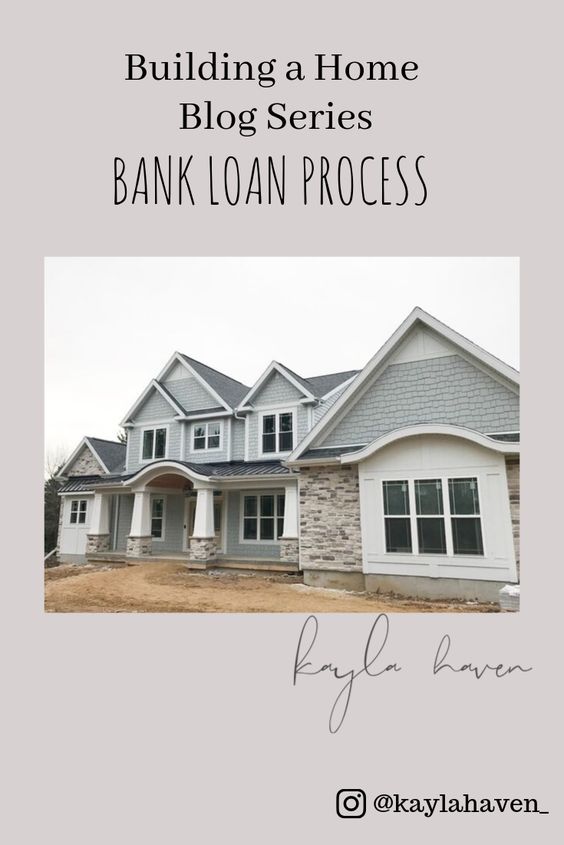

Great pre-construction pic of alex and breckum!!

Hi Kayla, I am enjoying reading about your experiences. Thank you so much for sharing! I’m not sure my husband and I will ever take the leap to build our own house….if we can’t find a screen porch on our next home way into the future, we might have to build it!